Variable Asset to High Value Investment by Second Citizenship

Variable Asset to High-Value Investment by Second Citizenship Modern technology and freedom of travel have both succeeded in bringing individuals closer together, revolutionizing the way people communicate, work and maintain connections. In the past few years, advances in technology have influenced every facet of day-to-day living whether we realize it or not, and the emergence of hundreds of new digital currencies is proof that the way we manage our finances is no exception to this progression.

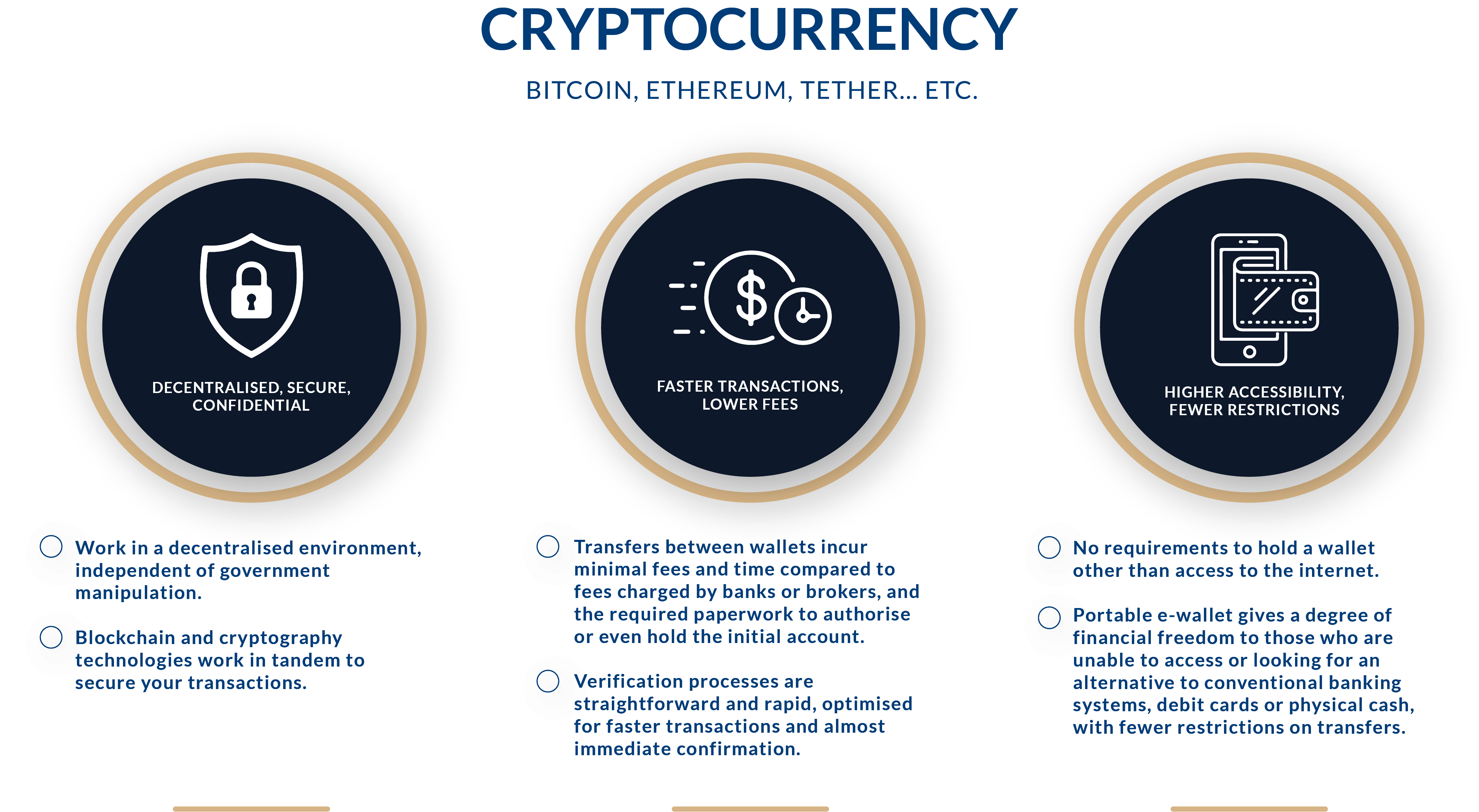

Bitcoin, Ethereum, and Tether have become modern buzzwords, understood as being new forms of currency, but what are they?

Cryptocurrencies are secure digital assets used to conduct financial transactions, operating in a decentralized manner independently of banks.

The ‘crypto’ in cryptocurrency refers to cryptography, the process of securing communication, transactions, and information through the use of coded encryption and decryption.

This exchange medium utilizes a linked record of transfers across a peer-to-peer network known as the blockchain. Together, these systems allow individuals to perform secure, high-integrity transactions without the need for a third party such as a bank.

Why invest in (Residency or) Second Citizenship with Cryptocurrency?

Previously seen as a luxury item, many would argue a second passport is now an essential tool to unlock mobility, lifestyle benefits, and business opportunities often impinged on by foreign policy. CBI gives freedom of migration options that can be passed to future generations and include family members.

A number of programs including Vanuatu, Antigua & Barbuda, St. Kitts & Nevis, and Portugal are becoming increasingly crypto-friendly, implementing new laws with regard to digital assets, accepting cryptocurrency payments, and recognizing the increasing reach of digital currencies.

- Despite its undeniable potential for growth, crypto is highly volatile with no maintained value. Second citizenship is an asset that will not depreciate, providing lifelong and multigenerational benefits.

- Many CBI and RBI countries have tax laws favorable to crypto investors allowing for a greater degree of international wealth management and optimization.

- From recent global events, it has become apparent that freedom of travel can be easily tied to citizenship. Citizenship by investment is a route to provide additional opportunities for unbarred movement with programs such as St. Kitts & Nevis Citizenship by Investment program offering passport holders access to over 150 countries, visa-free.

- This additional layer of security is an invaluable insurance policy against restriction in an unpredictable global environment.

- Many countries are not yet fully cryptocurrency friendly but there are an increasing number of options for investors’ digital assets to be utilized as legitimately recognized funds. Programs are rapidly evolving in flexibility given the diversity of modern liquid capital.

- The introduction of a Virtual Asset Bill in St. Kitts and Nevis seeks to give cryptocurrency investors an additional layer of confidence and security when legally managing their digital assets.

- Global asset allocation and exploration of investment vanes with a high return are essential, and the best insurance policy to manage risk and volatile markets is a varied portfolio. Investing in second citizenship serves as another route to diversify your assets, cementing your status as a global citizen and providing an immeasurable return on your investment.

Many Citizenships by investment programs including St. Lucia, Grenada, Dominica, St. Kitts, Nevis, and Vanuatu have no visit requirement; closed borders are not a barrier to taking the first step towards future security.

Contact us today to find out how we can help you turn your digital investment into a tangible asset for life.